Bahria Town Karachi: Property Valuation and Advance Tax Details by FBR

Recent imposition of advance taxes and valuation by the FBR has caused severe damage to the property market recently. Bahria Town Karachi is also no exception. Advance taxes on buying or selling of property were imposed in September 2016 when bahria town rolled out a notification about the new taxes.

There are some serious issues with the valuation strategy also, however it is finalized and applied now for all property transfers in bahria town karachi.

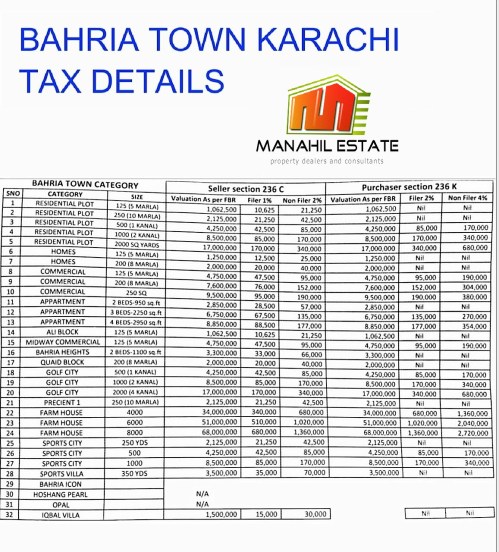

According to the tax law, a non-filer buyer will pay 4% advance tax whereas filer will pay 2% advance tax during transfer of a property. Similarly, property owner will pay 2% advance tax if he is non-filer, whereas filer will pay 1% advance tax during property transfer.

Minimum property value on which the tax applies is 40 lacs, which means buyer will not pay any tax if the valuation table shows the value less than 40 lacs. However, seller doesn’t enjoy such relaxation.

Since Bahria Town Karachi has many properties which are still just files, i.e. no plot/home numbers yet. Such unballoted files are not liable to be taxed, so old commercials, unballoted plots and homes are exempt from these advance taxes.

Following is the valuation table as defined by FBR and the calculation of advance taxes to be paid by buyer and seller:

You can see in the list that some prices are fairly lower than market, while other are priced higher. Sports City is also included in the list, so that means you will be taxed immediately after these files are balloted. You will note that residential plots are priced higher than homes, which means valuation wasn’t fair. Homes cost more than plots but plots have higher sale purchase activity. So, the valuation is aimed to target more sellable items rather than determining a fair value for each property type. This additional cost while purchasing or selling a property has discouraged investors and caused general slowdown in sale purchase activity.

We expect that a new tax policy will be applied in which properties without possession won’t be taxed,as majority of buyers seek cheaper non-developed properties for investment or future use. So, either tax rate should be reduced or new machanism should be adopted so that investors can find some incentive in property trading.

Should you require more information on taxes, you can comment below for clarification.