FBR Modifies CGT and Advance Tax Policies on Property Transfers

Real estate market of Pakistan is currently under a lot of stress due to a number of sudden changes in the normal tax regime. In order to regularize this sector, the government has introduced some radical changes in the overall system of property sale and purchase, which may bear fruit in the long run but everything seems to have come to a halt at present.

Following are some major reforms related to immovable assets/properties which have been included in the Finance Act 2019:

- Removal of ban on non-filers for purchase of property worth above 50 lacs

- Increase in FBR property valuation rates for major cities

- Bank transactions mandatory for sale purchase of property

- Decrease in advance income tax percentage for property purchaser

- Removal of 40 lacs limit to levy advance tax on purchaser

- Progressive increase in Capital Gain Tax

- Increase in the number of years to be exempted from CGT

If we look at the number of changes included in the new finance act 2019, we will appreciate the removal of ban on non-filers, discouraging cash transactions, and decrease in advance income tax on property purchasers. The term “Non-Filer” will cease to exist after July 2019, as CNIC number of a Pakistani Citizen will become their NTN number from 1st of August, 2019.

On the other hand, increase in Capital Gain Tax and the increase in the number of years to apply CGT may be taken as negative measures which may discourage people to indulge in short term investments.

As per the revised advance income tax policy on property transfers, active tax paying seller will pay 1% of the fair market value, and non-active/non-filer seller will pay 2% of the fair market value. Advance tax on seller will not be applicable if a property is held for a period exceeding 5 years.

Similarly, an active tax paying purchaser will pay 1% of the fair market value of a property, and a non-active tax filing purchaser will pay 2% of the fair market value. The limit of 40 lacs to apply advance income tax on purchaser has been removed, i.e. advance tax will apply irrespective of the value of a property.

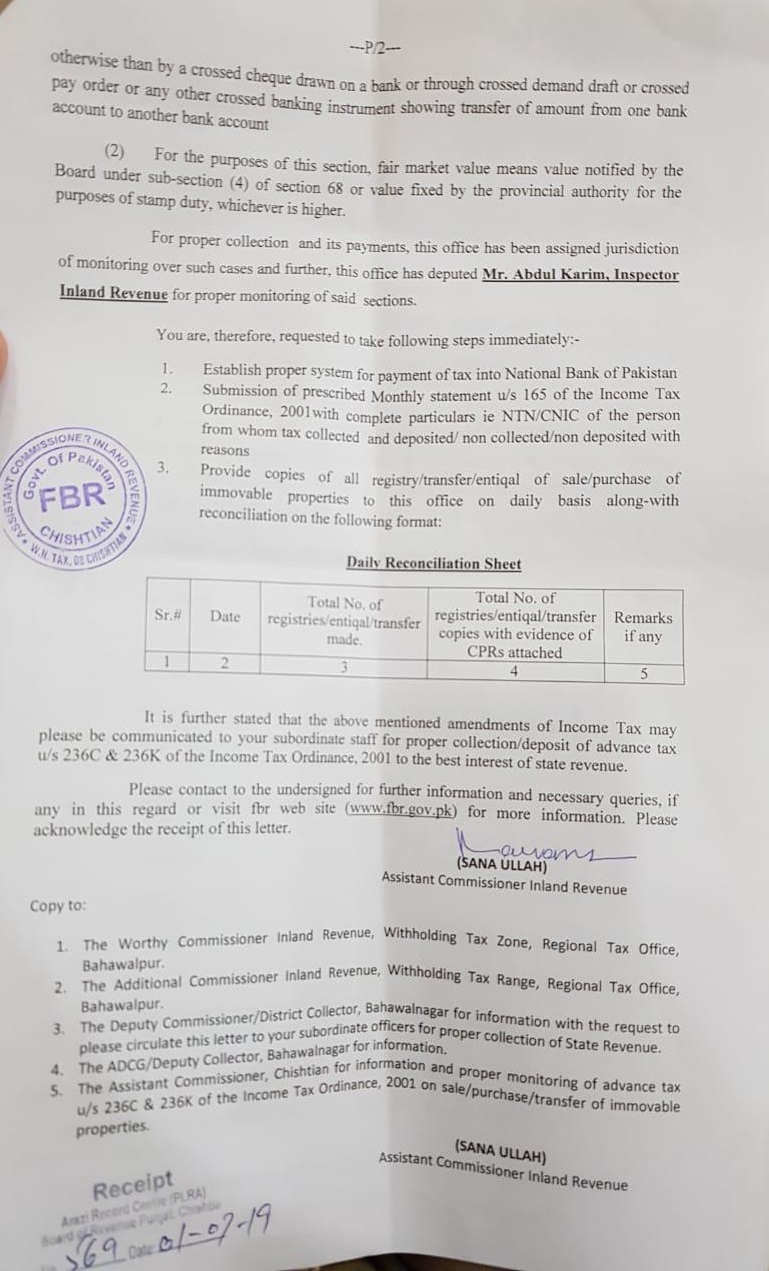

Another important step to stop the use of black money is to ensure bank transactions for property sale/purchase. As per new policy, a person cannot buy a property having fair market value above 50 lacs unless the transaction is done through crossed instruments, i.e. checks, pay orders and drafts which show movement of money from one account to another.

In order to bring official property valuation rates at par with the prevailing market prices, FBR has once again revised the property valuations in all major cities of Pakistan. So, decrease in tax rate may not essentially mean the reduction in cost.

Another major change with regard to property transactions is the Capital Gain Tax (CGT). A progressive tax system has been applied on the gain on disposal of an immovable property which includes an open plot and a built up property.

Following is the CGT tax percentage on the basis of real gain:

- If Capital Gain is less than 5 million, CGT will be 5%.

- If Capital Gain is above 5 million but below 10 million, CGT will be 10%.

- If Capital Gain is above 10 million but below 15 million, CGT will be 15%.

- If Capital Gain is above 15 million, CGT will be 20%.

The time period to apply gain tax has also be increased from 3 years. The revised time period is given as under:

- For Open Plot: 8 Years

- For Built-Up Property: 4 Years

You can download the complete file of Finance Act 2019 at the link attached below:

You can check the amendment letter of advance income tax on properties below: